Pay staff and report payroll details to the ATO with online payroll software. Automate tax, pay and super calculations.

- Single Touch Payroll sorted

- Automated online payroll

- Employee self-service

Xero recently added a payroll module to its popular business accounts package.

The payroll section is accessed through the main site, and allows employers to deal with pay, employer taxes and pensions all in one place alongside Xero’s core bookkeeping interface.

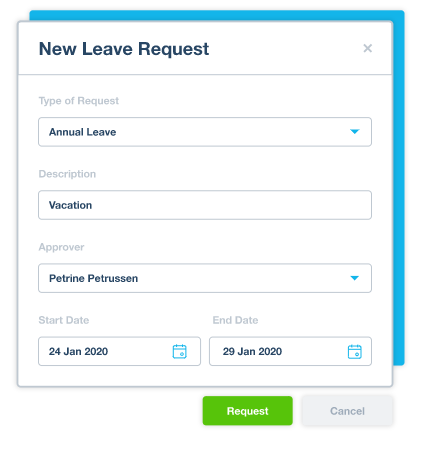

Once you have the data entered, the payslip can be sent out by email, or you can give your employees self-service access using the Xero me app. They can also use this to submit timesheets and apply for leave, which is a particularly handy feature.

Pension rules have become more complicated over the past few years, with employees and employers having to contribute to a pension plan, and employers having to set up a pension scheme for employees if they don’t already have one via the process of auto enrolment. Xero Payroll takes care of all of this and can send data directly to Nest (the most common scheme), with the click of a button.

The core payroll software is set up to be flexible, so it can handle, weekly, monthly or fortnightly pay. In addition to tracking annual holiday allowance and handling holiday requests, it can also deal with statutory pay calculations, maternity and paternity pay and leave, and correctly adjust the payslips to reflect all this.

Employee expenses can also be handled through the payroll system and be reimbursed at the same time as payroll is run.

Once all of this is done, Xero is able to prepare the PAYE submission and send this directly to HMRC. And because all this data is kept within Xero, it makes it easy to keep on top of the bookkeeping for this process.

With the addition of Xero’s native payment system, you can also trigger bank payments without leaving the Xero platform.

There are a number of other third-party payroll providers that integrate well into Xero, so we’re very happy to talk you through the pros and cons of their proposition and provide training once you have select the right applications for your business.

Simplify payroll and report to the ATO each pay day as required by Single Touch Payroll. Pay your employees with accounting and payroll software all in one

Single Touch Payroll sorted

Use Xero payroll software to simplify compliance with the ATO.

- Lodge salary, wage, PAYG and superannuation details

- Send Single Touch Payroll reports each payday

Automated online payroll

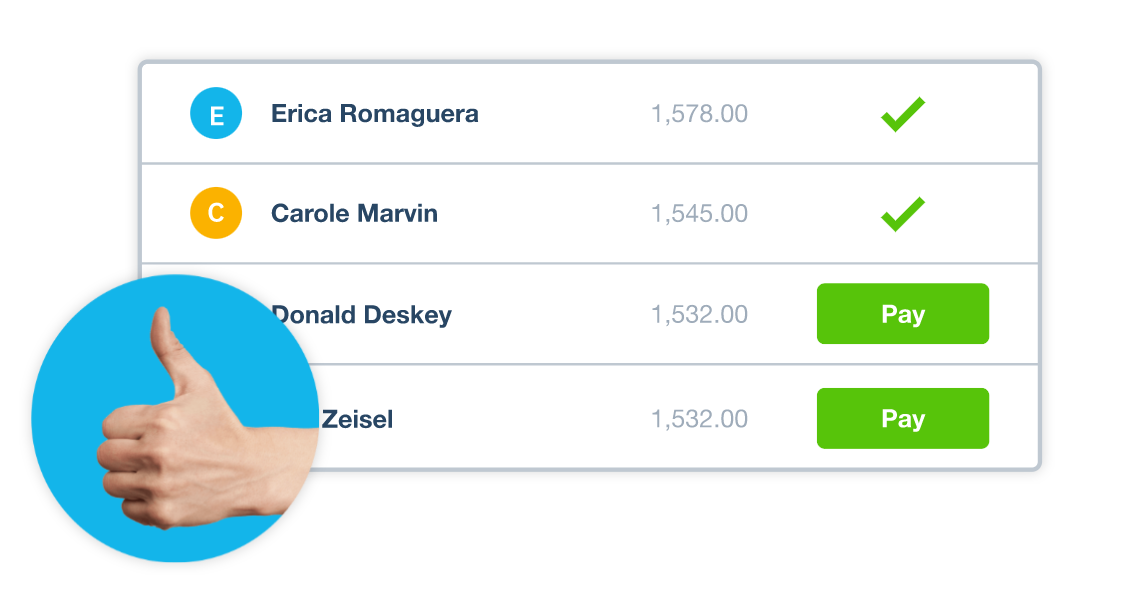

Pay employees in just a few clicks using Xero payroll software. Payroll data updates your accounts automatically.

- Automatic tax, superannuation and leave calculations

- Flexible pay calendars, tax and pay rates

- Email payslips and let employees view them online

For accountants and bookkeepers Keep your practice a step ahead with Xero accounting software.

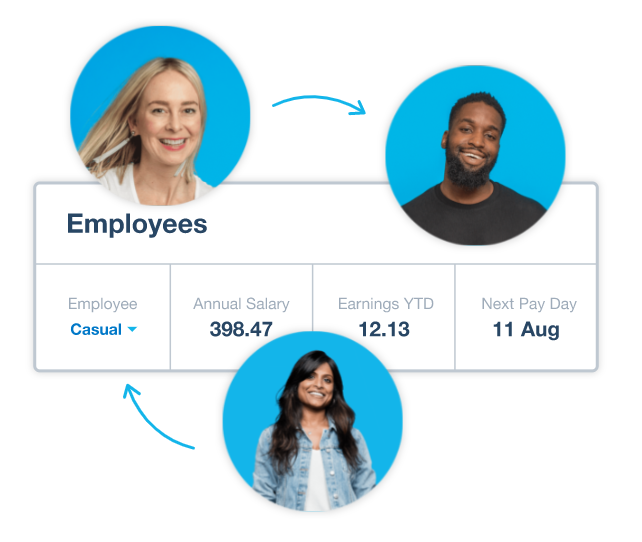

Employee self-service

Reduce payroll admin and save time by giving your employees limited access via the Xero Me mobile app or the web.

- Let staff submit leave requests and timesheets for review

- Allow employees to view leave balances and payslips

- Use the Xero Me mobile app or Xero Me on the web

Need Assistance with Xero Accounting?

DISCLAIMER: www.kayabooks.co.uk is third party organization that does not claim any collaboration with Xero. All the logos and images we use on our website are to fulfill the purpose of website advertisement only. We claim no interference with any organization.